With the right strategies, you can minimize liabilities, keep more of what you earn, and align your taxes with your overall financial goals.

Plans built around your unique goals.

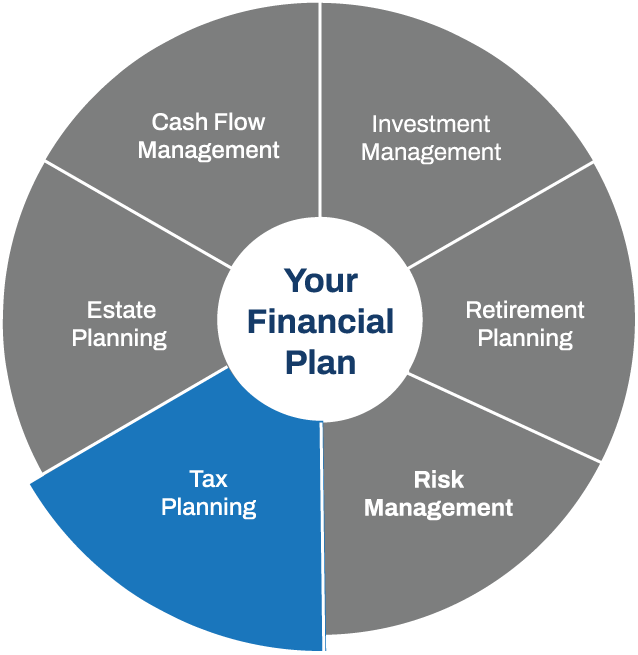

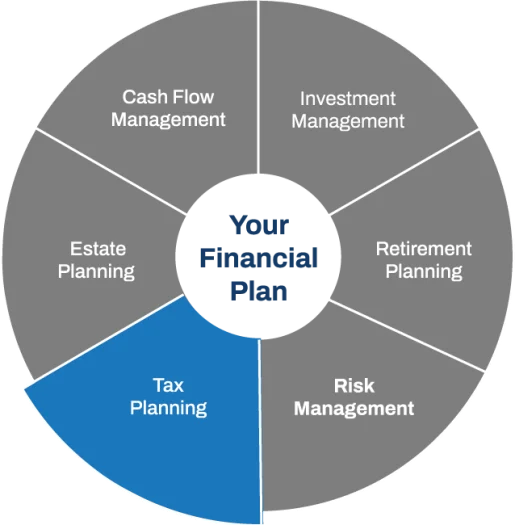

Tax strategy fits with your financial plan.

Recommendations you can understand and act on.

Managing your taxes effectively is about more than just filing on time. Without a strategy, you could be missing opportunities to save. Many individuals and small business owners struggle with:

Working with experienced tax planning professionals helps keep your strategy proactive, not reactive, giving you clear steps you can take today to be more confident and save more tomorrow.

Taxes influence every decision you make, from saving for retirement to investing for growth to preparing your estate. That’s why we integrate tax planning into your bigger financial picture. Our approach makes sure each piece of your plan supports the others, giving you a stronger foundation for long-term success.

"I am so grateful to have been introduced and working with CPC Wealth Management for some time now. Everyone is so nice and knowledgeable. Makes you feel way more comfortable and excited for your future when you have professionals that not only know what they are talking about, but stay active in your account a lot. The staff is incredible. Chris Calabro, Pasquale Palumbo, and Taylor Miano are just so accommodating and incredible. Thank you guys for everything and look forward to the future. Would definitely recommend to everyone.."

"Pasquale Palumbo has been my financial advisor for over a year. At first my husband was hesitant on hiring an advisor but he quickly came to realize it was much needed ! Pasquale is insanely good at what he does, he is also kind hearted and is ways available to answer any questions we might have . I highly recommend CPCs SERVICES !"

"Working with Chris and Pasquale has given me greater clarity and peace of mind around my finances, and I would highly recommend CPC Wealth Management to anyone looking for a trusted, professional financial planning team."

*The Forbes ranking of Top Next-Generation Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative and quantitative data, rating thousands of wealth advisors born in or after 1980. Advisors are interviewed by telephone and in person to evaluate service models, investing process, experience levels and integrity. Additional factors considered include compliance record, client retention, revenues produced for their firms and assets managed. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receives a fee in exchange for rankings.

**This statement is a testimonial by a client of the financial professional as of 12/19/2025. The client has not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial.

***This statement is a testimonial by a client of the financial professional as of 1/10/2026. The client has not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial.

****This statement is a testimonial by a client of the financial professional as of 12/12/2025. The client has not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial.

CPC Wealth Management provides a full range of tax planning options for both individuals and small business owners. Whether you’re looking to lower your annual tax bill, prepare for retirement, or structure your business more efficiently, our team can help uncover opportunities to reduce liabilities and grow wealth.

*Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA. (22-LPL)

Tax rules can be overwhelming, but they don’t have to be. At CPC Wealth Management, we simplify the jargon and break down complicated concepts into clear, actionable steps.

While we don’t file your taxes directly, we work closely with your CPA or trusted tax professional to ensure your tax planning fits into your overall financial plan.

When you work with CPC Wealth Management, you’ll receive:

We align your tax plan with your income, investments, retirement goals, and estate planning.

Professional recommendations aimed at making your taxes work for you.

As tax laws or your circumstances change, we proactively adjust strategies to keep you ahead.

Track your financial and tax planning details anytime through our client portal.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor. LPL Financial does not offer tax advice.