Our experienced investment advisors offer done-for-you investing & portfolio management to keep your investments aligned with your financial plan.

Tailored to your financial goals.

Personalized recommendations.

Real-time dashboard access.

Fine-tune & monitor your portfolio.

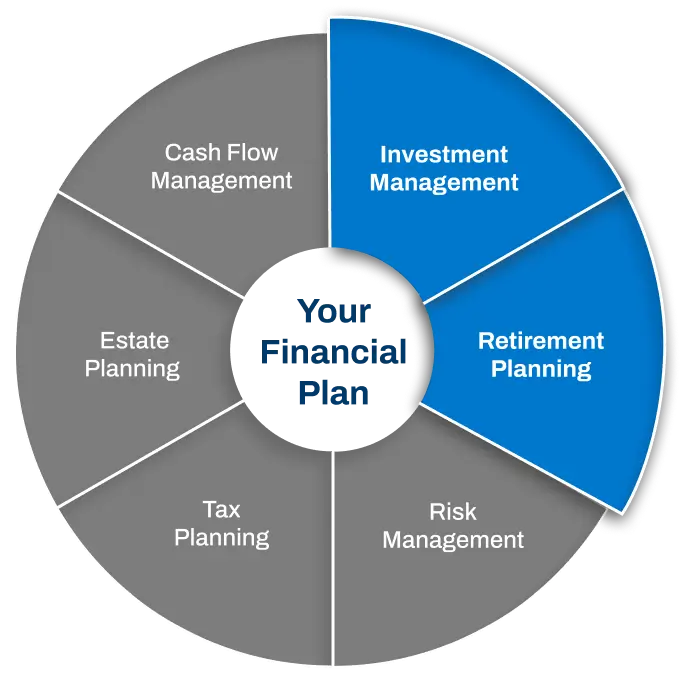

At CPC Wealth Management, we understand that your investments are a critical part of your larger financial plan. We’ll start by defining your investment goals and risk tolerance. Then, you’ll work with an investment advisor to build a diversified portfolio* that includes traditional brokerage accounts and qualified accounts for retirement and college savings. Your advisor handles it all from account setup to ongoing management of your investments.

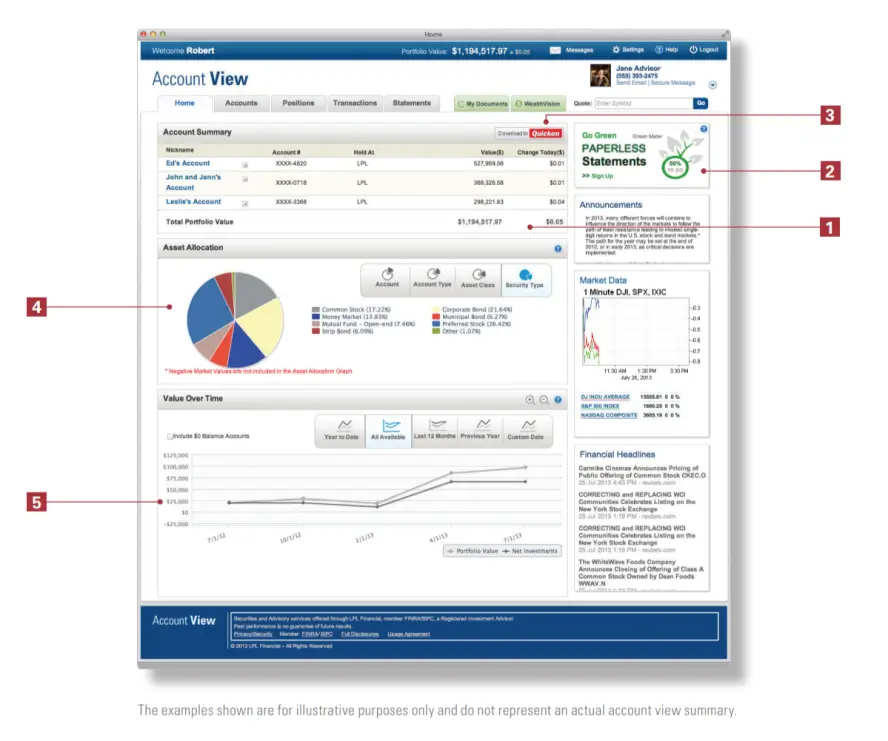

Each investment decision is coordinated with your retirement and tax planning to ensure every move aligns with your overall financial strategy. With our simple client dashboard and a close personal relationship with your advisor, you’ll always have a clear picture of how your money is working for you.

*There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

CPC Wealth Management provides everything you need for investing, from account setup to ongoing management, through our relationship with LPL Financial. Our team of experienced, independent advisors offer personalized advice to help you implement and fine-tune your investment strategy. Your advisor will continuously shape your portfolio so that you can focus on living your life confidently.

After creating your financial plan, work closely with our advisors to select the right investments and ensure proper diversification. Our experts help you make informed decisions tailored to your goals.

We handle the setup and management of your investment accounts, providing a done-for-you investing experience. From traditional brokerage accounts to retirement and college savings plans, your advisor handles it all.

Your investments are continuously coordinated with your financial plan. You also have access to our user-friendly client dashboard, offering real-time insights and easy management of your portfolio.

"I am so grateful to have been introduced and working with CPC Wealth Management for some time now. Everyone is so nice and knowledgeable. Makes you feel way more comfortable and excited for your future when you have professionals that not only know what they are talking about, but stay active in your account a lot. The staff is incredible. Chris Calabro, Pasquale Palumbo, and Taylor Miano are just so accommodating and incredible. Thank you guys for everything and look forward to the future. Would definitely recommend to everyone.."

"Pasquale Palumbo has been my financial advisor for over a year. At first my husband was hesitant on hiring an advisor but he quickly came to realize it was much needed ! Pasquale is insanely good at what he does, he is also kind hearted and is ways available to answer any questions we might have . I highly recommend CPCs SERVICES !"

"Working with Chris and Pasquale has given me greater clarity and peace of mind around my finances, and I would highly recommend CPC Wealth Management to anyone looking for a trusted, professional financial planning team."

*The Forbes ranking of Top Next-Generation Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative and quantitative data, rating thousands of wealth advisors born in or after 1980. Advisors are interviewed by telephone and in person to evaluate service models, investing process, experience levels and integrity. Additional factors considered include compliance record, client retention, revenues produced for their firms and assets managed. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receives a fee in exchange for rankings.

**This statement is a testimonial by a client of the financial professional as of 12/19/2025. The client has not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial.

***This statement is a testimonial by a client of the financial professional as of 1/10/2026. The client has not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial.

****This statement is a testimonial by a client of the financial professional as of 12/12/2025. The client has not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial.

Personalized advice and comprehensive portfolio management.

Recommendations without ties to specific financial products.

Continuous management and adjustment of your investments.

Easy access to your financial details anytime.

We'll leverage AI as a tool, not a replacement for personalized recommendations.