Owning a business can be one of the most powerful ways to build wealth, but high income does not automatically translate to financial security.

Many business owners do well financially and still feel uncertain about their financial future. Because without a plan, it is hard to know if the current approach is effective.

Why High Income Does Not Always Lead to Wealth

Money comes in, expenses go out, and whatever is left is handled later.

Over time, that creates a quiet problem. Despite working harder and earning more, progress feels slow. Savings feel unclear. Investing feels risky. And there is little confidence that today’s income is improving anything beyond the present.

This is not an income problem. It is a planning problem.

Without a clear system, income often:

- Feels inconsistent, even when revenue is strong

- Stay trapped in the business or idle in cash

- Get consumed by higher expenses over time

- Fail to translate into long-term personal wealth

The good news is that this can be improved upon.

Turning income into personal wealth does not require complex strategies or perfect timing. It starts with a few clear decisions that give direction to the money you are already earning.

Here are five ways business owners and entrepreneurs can begin doing just that.

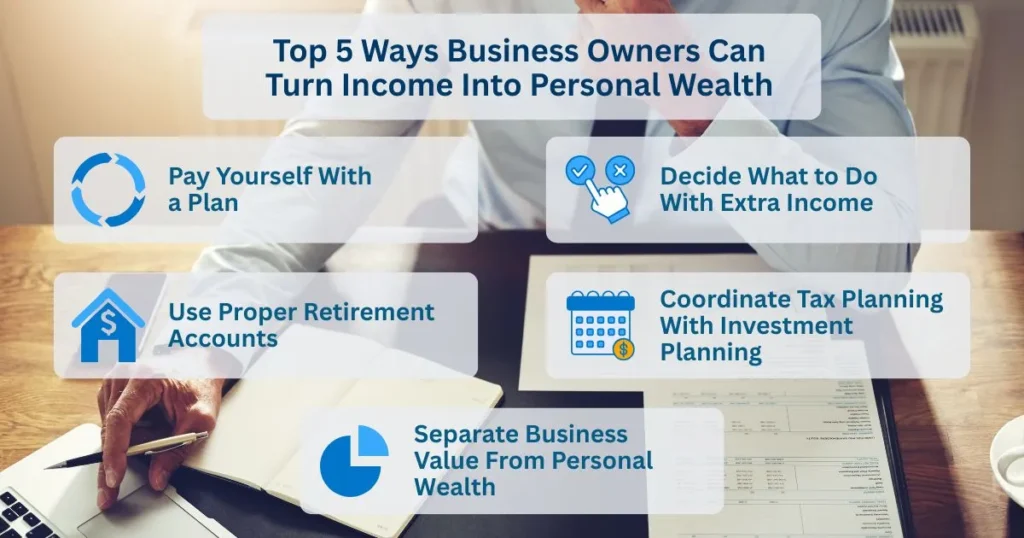

Top 5 Ways Business Owners Can Turn Income Into Personal Wealth

1. Pay Yourself With a Plan

One of the biggest mistakes business owners make is treating personal income as whatever is left over.

Without a defined pay structure, it becomes difficult to tell whether the business is actually supporting your personal financial goals or simply covering expenses as they come up.

Unpredictable income makes it hard to save and invest consistently.

Paying yourself with a plan helps you:

- Set a consistent salary or owner draw

- Separate business and personal finances

- Know exactly how much you can safely spend, save, and invest

Without clarity, even high income can feel unstable.

2. Use Proper Retirement Accounts for Business Owners

Business owners often have access to retirement strategies that employees cannot implement on their own. But many never use them correctly.

Depending on your situation, this might include:

- Solo 401(k)s

- SEP IRAs

- Cash balance plans

- Traditional or Roth IRAs as part of a broader strategy

Which accounts make sense depends on how your business is structured, how predictable income is, and how aggressively you want to save for the future.

The goal is not just to save money. It is to save in the most tax efficient way possible while building long-term wealth.

Choosing the wrong account, or no account at all, can slow progress over time.

3. Separate Business Value From Personal Wealth

Your business may be your largest asset. That does not mean it should be your only one.

Relying entirely on your business creates risk. Industries change. Revenue fluctuates. Life happens.

When most of your net worth is tied to the business, even short-term uncertainty can create pressure to make decisions based on cash flow instead of your goals.

Building personal wealth involves:

- Investing outside of your business

- Avoiding having all of your net worth tied to one company

- Creating assets that grow whether or not you are actively working

Diversification applies to your entire financial life, not just your investment portfolio.*

*There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. (26-LPL)

4. Decide What to Do With Extra Income

As income grows, spending often grows with it. Not because of bad choices, but because it happens naturally.

Small upgrades turn into higher monthly expenses. Over time, higher income does not lead to more security.

Deciding ahead of time where extra income goes helps prevent that.

For example:

- Putting a portion of extra income toward investments

- Increasing retirement contributions as revenue grows

- Keeping fixed expenses steady even as income rises

Without a clear plan, extra income rarely goes toward the things that matter most. It gets absorbed into day-to-day spending without you noticing.

5. Coordinate Tax Planning With Investment Planning

Taxes are often one of the largest expenses business owners face. Yet many financial decisions are made without considering the tax impact.

Income decisions, retirement contributions, and investment activity all affect your tax bill.

When tax and investment decisions are made separately, the consequences usually show up later. And it’s often when there is less flexibility to adjust.

When tax and investment decisions are coordinated, you can:

- Keep more of what you earn

- Reduce surprises at tax time

- Make smarter long-term decisions as your income grows

Coordinating tax planning with investment decisions helps business owners avoid unnecessary mistakes and keep more control over their cash flow as income grows.

Maximize Your Earnings to Build Personal Wealth

Strong income creates opportunity, but it does not guarantee progress. What matters is whether that income is organized around decisions that support your goals.

When pay structure, retirement planning, investing, and tax decisions work together, income becomes easier to manage and more effective over time.

That coordination is what allows earnings to build personal wealth instead of simply covering the present.

Unsure If You’re Maximizing Your Business Income?

If you are a business owner but unsure whether your current approach is moving you in the right direction, it may be time to step back and evaluate how your income is being used.

At CPC Wealth Management, our approach to wealth management for business owners looks at your full picture. Income, investments, taxes, and goals are considered together instead of in isolation.

That coordination is often what allows strong earnings to translate into personal wealth over time.

If you want clarity around your next steps, start a no pressure conversation and see how CPC Wealth Management can help you plan your financial future.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

LPL Financial does not provide legal advice or services, or tax advice or services.

Securities and Advisory Services offered through LPL Financial, a Registered Investment Advisor. Member FINRA/SIPC.