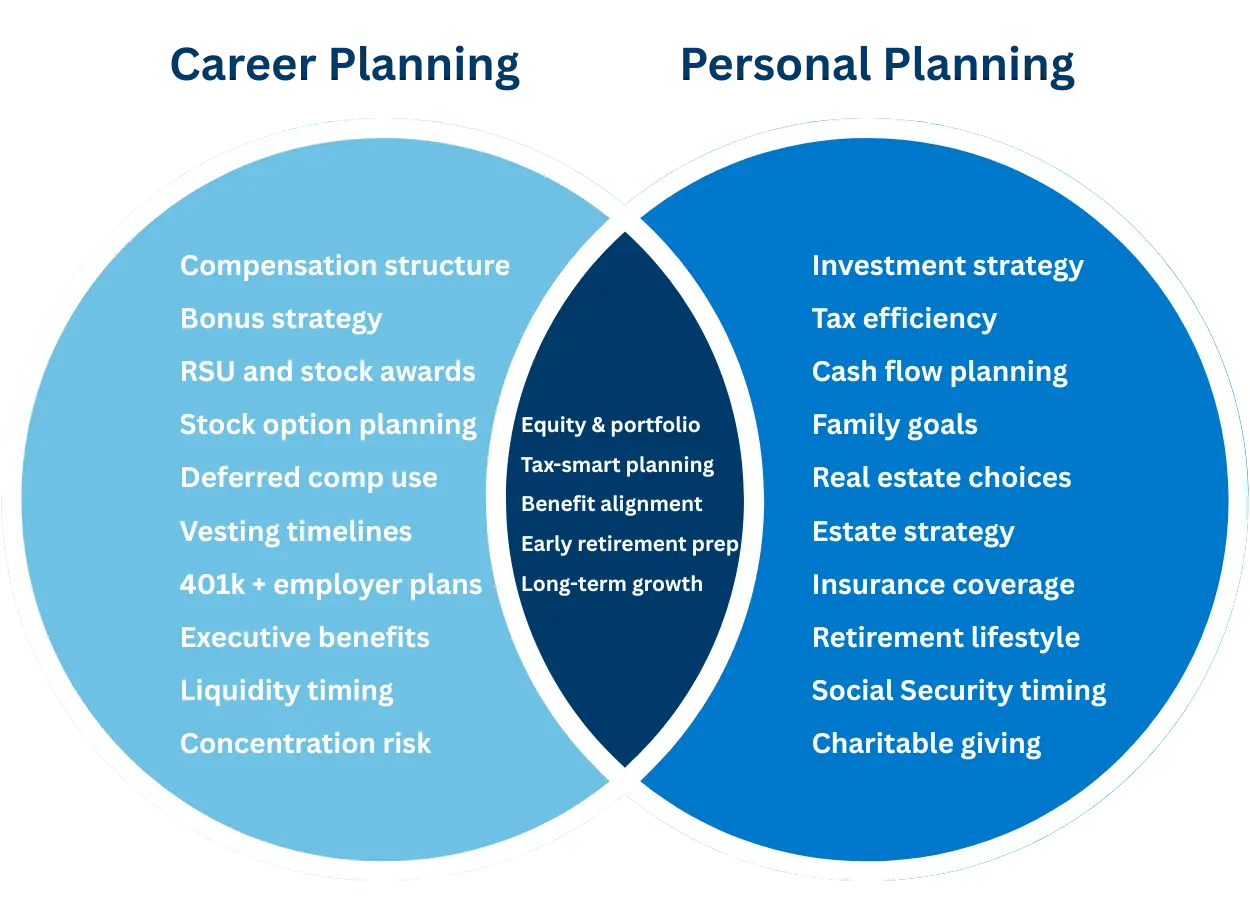

As your career grows, so does the complexity of your financial life. Our planning and wealth management helps you make the most of your compensation, equity, and opportunities.

Strategically use bonuses, deferred comp, and benefits.

Manage RSUs, stock, and concentration risk wisely.

Plan your work-optional future with confidence.

Many corporate professionals build wealth through salary, bonuses, equity and benefits, but still feel unsure if everything is working as efficiently as it could. You might be wondering about:

When compensation becomes layered and equity builds, structured planning and wealth management brings clarity, efficiency and forward financial momentum.

High-earning professionals face unique decisions around compensation, equity, tax exposure and ongoing planning. CPC Wealth Management helps you understand every moving part and turn your income and benefits into a coordinated path forward.

Together, we build a strategy designed for stability, growth, and flexibility throughout your career, so you can live well now and protect the future that matters to you and your family.

If you’re an executive, it’s crucial that your financial planning encompasses more than just your salary and investments. These six key areas work together to guide the financial choices that matter most.

Manage salary, bonuses, and deferred comp in a way that supports your lifestyle and long term plans.

Protect wealth with insurance and risk control suited to high-earning households.

Plan for financial independence, early retirement, or phased transition on your terms.

Create a disciplined investment strategy that balances equity exposure with the risk you are willing to take.

Preserve your wealth, support family goals, and prepare for long-term legacy needs.

Coordinate income timing, equity taxation, and deductions to keep more of what you earn.

A financial plan for corporate and executive professionals should take into account your entire financial picture. With your goals as our guide, we build your financial framework to be strong, coordinated, and future-focused.

The outcome is a strategy that grows with your career, strengthens your financial position, and supports the lifestyle you want today while protecting your wealth for the future.

"Much time has passed, the ups and downs of the market, his personal growth, and mine has been an education and a constant reminder of his commitment to my wealth and well-being . Chris has a old school work ethic and always has my best interest in mind."

"Through the years, I continued to retain Robert as my financial advisor as he has gained my confidence, trust and respect."

"Chris is knowledgeable, kind and helpful. I am happy to say I am now a very satisfied client of Chris Calabro. He is always available to offer advice and answer any questions. I am confident that he always has my best interest in mind."

Executives work with us for guidance that simplifies decisions and brings everything together clearly.

We help you manage RSUs, deferred comp and stock awards with informed decision-making.

We help you minimize unnecessary tax exposure through structured planning and allocation.

We guide decisions year-round, helping you stay confident through career and market changes.

We bring every part of your financial life together in a unified plan that adapts as your needs evolve.

*The Forbes ranking of Top Next-Generation Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative and quantitative data, rating thousands of wealth advisors born in or after 1980. Advisors are interviewed by telephone and in person to evaluate service models, investing process, experience levels and integrity. Additional factors considered include compliance record, client retention, revenues produced for their firms and assets managed. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receives a fee in exchange for rankings.

**This statement is a testimonial by a client of the financial professional as of 12/19/2022. The client has not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial.

***This statement is a testimonial by a client of the financial professional as of 12/23/2022. The client has not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial.

****This statement is a testimonial by a client of the financial professional as of 9/05/2023. The client has not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial.